ri tax rate income

2022 Rhode Island state sales tax. DO NOT use to figure your Rhode Island tax.

How Is Tax Liability Calculated Common Tax Questions Answered

Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

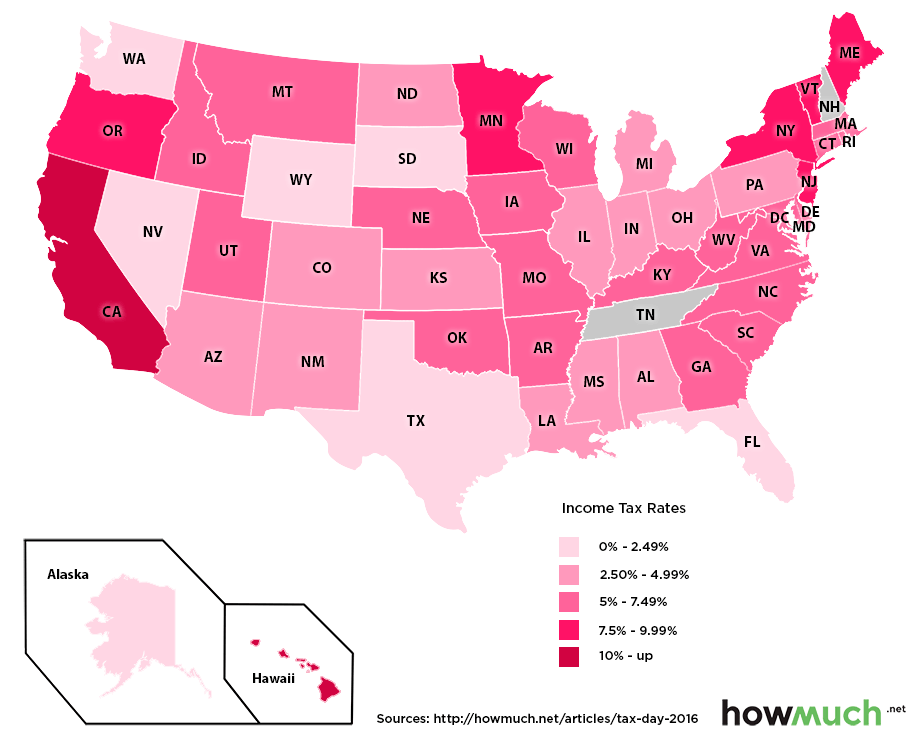

. The rhode island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2021. The income tax is progressive tax with rates ranging from 375 up to 599. The highest marginal rate applies to taxpayers earning more than 148350 for tax year 2020.

The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax. Money from renting out property. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that.

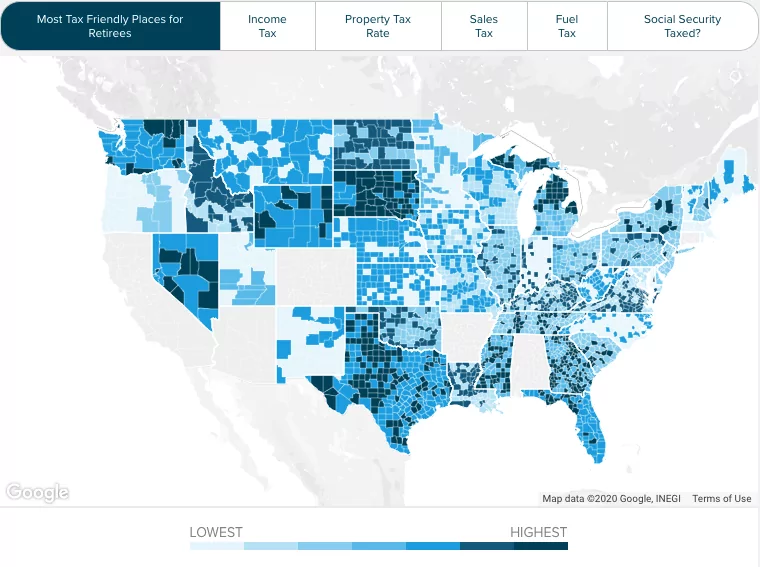

Rhode Island taxes most retirement income at rates ranging from 375 to 599. Any income over 150550 would be taxes at the highest rate of 599. Exact tax amount may vary for different items.

The tax breakdown can be found on the Rhode Island Department of Revenue website. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

Counties and cities are not allowed to collect local sales taxes. 65250 148350 CAUTION. The current tax forms and tables should be consulted for the current rate.

Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax. Taxable income between 65250 and 148350 is taxed at 475 and taxable income higher that amount is taxed at 599. The range where your annual income falls is the rate at which you can expect your income to be taxed.

The employer tax rates in these schedules include a 021 Job Development Assessment which is credited to the Job Development Fund and a 003 Reemployment Assessment for calendar years 2001 2002and 2003 that is credited to the Employment Security Reemployment Fund. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. This page has the latest Rhode.

Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. The first 65250 of Rhode Island taxable income is taxed at 375. Each tax bracket corresponds to an income range.

The first step towards understanding Rhode Islands tax code is knowing the basics. Levels of taxable income. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. The rates range from 375 to 599. Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly.

RI Division of Taxation One Capitol Hill Providence RI 02908-5806 4. Read the Rhode Island income tax tables for Married Filing Jointly filers published inside the Form 1040 Instructions booklet for more information. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 244688 639413 375 475 599 on excess 0 65250 148350.

It is one of the few states to tax Social Security retirement benefits though. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. 9050 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet.

3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three. Below we have highlighted a number of tax rates ranks and measures detailing Rhode Islands income tax business tax sales tax and property tax systems. How does Rhode Island rank.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. The rates range from 375 to 599. He said he signed onto legislation to raise the top income tax rate on about 5000 Rhode Islanders earning 500000 or more from 599 to 899 to make the tax fairer.

2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The Rhode Island tax is based on federal adjusted gross income subject to modification. Of the on amount Over But Not Over Pay Excess over 0 66200.

3 rows Rhode Islands 2022 income tax ranges from 375 to 599. Head of household 13550 RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2 Mailing address. COMPUTATION OF INDIVIDUAL EMPLOYER TAX RATE.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Read the Rhode Island income tax tables for Single filers published inside the. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599.

Rhode Island does not have any local income taxes. Click the tabs below to explore. In Rhode Island the more you make the more youre taxed.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Now that were done with federal income taxes lets tackle Rhode Island state taxes.

Rhode Island Estate Tax Everything You Need To Know Smartasset

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Calculator Smartasset

Rhode Island Retirement Tax Friendliness Smartasset

Which U S States Have The Lowest Income Taxes

State Income Tax Rates Highest Lowest 2021 Changes

Rhode Island Income Tax Calculator Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep Income Tax State Tax Low Taxes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island Sales Tax Small Business Guide Truic

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)